'Bean' there before

A little over a year ago, Howard Schultz, then chairman of Starbucks wrote an internal memo lamenting the loss of Starbucks' distinctiveness. He wondered openly whether in the mad rush to expand and grow ever more operationally efficient (as measured by speed and same-store sales increases, rather than quality of experience), the company had lost a bit of its soul.

This memo was reported in all the major business papers and spurred a flood of blog postings from Starbucks critics and fans as Schultz seemed to have captured what was on everyone's minds, although still at that time, a largely unspoken feeling.

I too wrote an article taking a very different slant and documenting how and why Starbucks had allowed itself to evolve from being the market disruptor to the disruptee as a number of major foodservice chains began to compete on many of the now commoditized (and watered-down) features of the Starbucks experience -- better quality coffee, much lower price, more inviting workspaces to stay the afternoon and work or lounge, free WiFi, faster service and so on.

Through the remainder of 2007, it became increasingly clear that the days of heady growth, at least in North America, were indeed over, and that Starbucks competitors were taking direct aim at the weaknesses in Starbucks' business model armor that had crept into their operations over the preceding 10 years.

The company still looked healthy on paper, with year-over-year revenues in 2007 22% ahead of 2006 and record net income (profit). But, trouble signs included dramatically slowing same-store sales growth which had clearly reached a limit, and a large number of customers opting for the improved, more widely available and cheaper coffee solutions of the competition as I predicted in last year's article.

Additionally, by the end of 2007, long-time Starbucks loyalists were increasingly grumbling about what was wrong with the company and voting for change by going less frequently, or going elsewhere entirely.

Hello. My name is Howard. Remember me?

As if sensing that the tide of success was turning against his prodigy, Schultz moved back into the driver's seat at the company he built in January 2008, reassuming the CEO role and announcing a return to the basics of Starbucks vision and identity. While acknowledging that the competitive landscape was different, Schultz asserted that the problems at Starbucks were internally generated for the most part, and that the solution lay in self-examination, putting the primacy of the customer experience first again, and getting back to the core mission that had made Starbucks successful in the first place.

Since January, Schultz has been busy righting the ship with a number of dramatic changes, many of which were easy to predict and well-designed to rally the faithful. Last week, the most significant (economic) announcement was made, with 600 store closings and up to 12,000 layoffs coming, and it caught the attention of the business media, partly as a bellwether indicator of the down economy. Certainly that's the way Starbucks spun it, but is it the whole story (or even the right story)?

Slow train coming

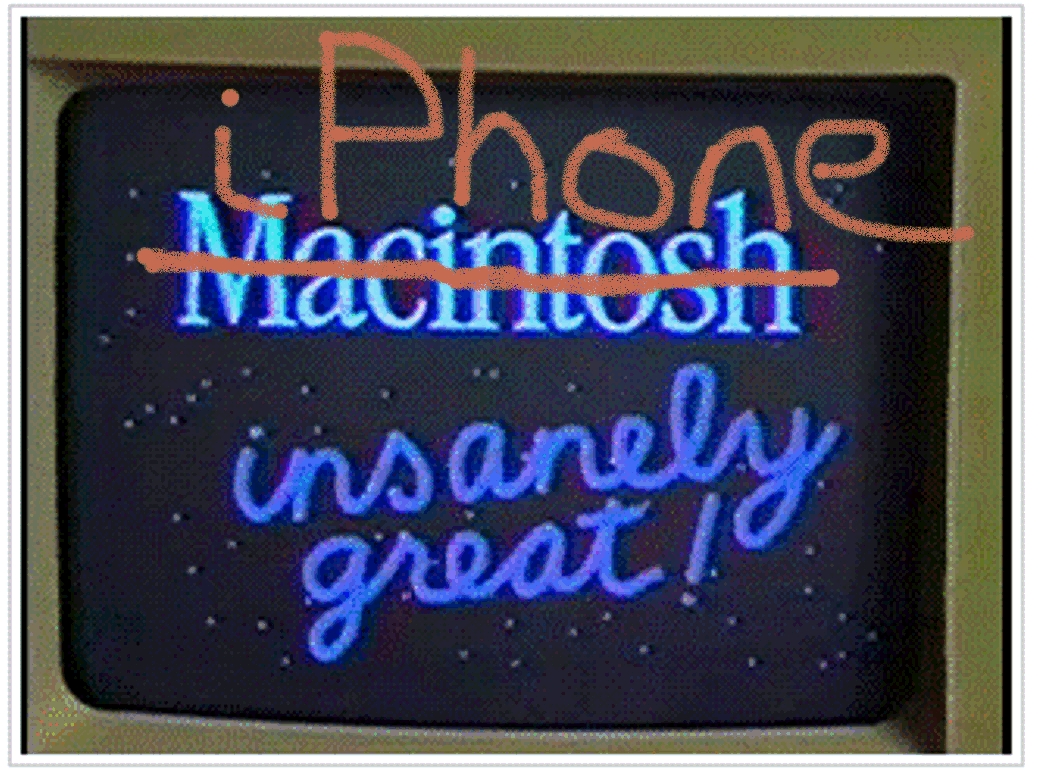

Starbucks pre-bagged beans. Might be fresher, but that sweet coffee smell just isn't the same when you walk in the door.

In last year's article I identified several signs of disruption and difficult decisions for Starbucks to avert or at least parry with the competition disruption that Starbucks own mistakes had enabled (although in their defense and viewed from an internal "operations" perspective, these would have been perfectly logical innovations to improve efficiency, profitability and leverage the brand through extensions). These included:

- pre-bagging coffee beans to preserve freshness (in the process, killing the distinctive coffee smell of an authentic neighborhood coffee bar, and the sensuality of sounds and sights such as scooping of beans, weighing and pouring them into custom bags, etc.)

- expansion of chain to be almost as ubiquitous as McDonalds (turning them into a "true chain" experience, common but still expensive)

- conversion from manual expresso machines to automatic to improve speed, efficiency and consistency of coffee making (at the expense of smells, theatre and "hand-made" quality)

- dilution of brand experience due to rapid expansion, higher staff turnover and lower training standards, resulting in surly and uncaring baristas

- introduction of warmed breakfast sandwiches and other foodservice items as a further brand extension (more brand and customer experience dilution)

- expansion of music retailing operations (more brand and experience dilution)

- expansion of branded non-food and non-music retail operations (more brand and experience dilution)

- new "low end" competitors entering market serving "good enough" coffee options (upgraded coffee roasts, espresso and capuccino, "third place" alternatives) at significantly lower prices

Our recommendations included:

- undoing the conversion of coffee bars into retail emporiums, restoring the "third place" ambiance and experience

- improving training

- getting rid of automatic espresso machines that made Starbucks just equal (in perception) to the lower-priced competitive options for many consumers

- acknowledging that new "low-end" disruptors (McDonalds, Dunkin Donuts, local gas stations) selling fresh-brewed espresso at 25% of Starbucks price changed the game and required a specific competitive response

- closing stores because the "coffee aficionado" market was already over-served (in the US market) given "good enough" competition at much lower price points

It's important to note that a few of these are counter-intuitive (at least to most by-the-book MBAs), and options that most businesses wouldn't consider.

For example, when I discussed the installation of automatic espresso machines last year, it was noted that the original decision to do this had cost millions of dollars. Replacing them would potentially both slow down service and retire perfectly good equipment before it was fully depreciated and had reached its natural end of life. (Although the equipment was a "sunk cost", most businesses that had made such a decision in the first place would not easily reverse it and incur additional expenses to restore an "experience" and recreate the lost competitive differentiation.)

And what has Schultz done?

The Clover Coffee Machine will elevate the quality and freshness of regular brewed coffee to the premium level that coffee enthusiasts expect, but not so for Starbucks espresso coffees, which will be even more automated than before with the Mastrena, reducing baristas to button pushers. Click on the image to read how the Clover system works.

- get rid of breakfast sandwiches by end of 2008 (announced Jan 30), to eliminate strong smells that compete with coffee

- slow pace of new openings and close 100 underperforming stores in US (announced Jan 30)

- stop reporting on year-over- year same-store sales growth (announced Jan 30), which could only be achieved in long term by continued dilution of brand experience through increased retailing options

- upgrade "partner" (i.e. barista, counter clerks, store management) training to re-focus on exceeding customer expectations and improve the overall experience (announced Jan 30)

- acquisition of The Coffee Equipment Company for its Clover brewing system -- a method which creates a vacuum to suck the steeping coffee through a filter to create an individually brewed cup similar to French press (which pushes the filter through the steeping coffee) to create a superior flavored cup of "traditionally" brewed coffee, with enhanced richness and body (announced Mar 19)

- introduce Mastrena espresso makers to replace current generation of automatic machines. (Although Schultz announced this, development of this machine, exclusive to Starbucks, was underway for 5 years.) Billed as enhancing the theater (because you can once again see the barista over its lower profile, and offering more control, it is still an automatic machine whose exclusivity doesn't address the quality and theatre lost with the old manual machines. (announced Mar 19)

- Loyalty rewards added to Starbucks cards. (announced Mar 19)

- Close 600 under-performing stores (up from only 100 under-performing stores in January). 12,000 employees will lose their jobs. (announced July 01)

Overall, the emphasis of these changes is essentially the same as the recommendations I made last year, with the exception of two key points, which I'll discuss below.

The stated purpose has been to:

- bring back the sense of theater

- enhance the Starbucks experience consistent with brand expectations

- put the emphasis back on coffee and hopefully undilute the brand identity

Unquestionably for drinkers of traditionally brewed coffee, the use of Clover machines to individually brew whatever you want from fresh ground beans (rather than chose from one of the three pre-selected coffees of the day) is a large improvement. Closing stores was expected because Starbucks was overbuilt, although Starbucks is blaming closures on the economy.

Is it the economy stupid, or is it really disruption?

For the first time ever, Starbucks has experienced a year-over-year decline in same store sales. The economy explanation has been picked up and widely reported in the media (because it fits the story that they want to report), but we have a hard time believing that Starbucks drinkers are consuming less coffee because of the price of gas.

More likely the economy is providing an incentive to the most price sensitive of Starbucks customers to switch to cheaper McDonalds or Dunkin Donuts alternatives, accelerating a trend that would have inevitably have happened anyway, due to the increasing availability of good enough low-end alternatives. Starbucks claims to have done research that disproves this, but we think they'd be wise to ignore the research, which is harder to prove than this more rational explanation.

The problem with drinking your own koolaid on something as strategic as protecting erosion of the customer base is that once people make peace with the mental switch from a high-end to low-end disruptive product, rationalizing that the low-end low cost alternative is good enough, they rarely go back.

The two things in the list of strategic changes that Schultz has implemented that are still at odds with "undisrupting" Starbucks are the switch to Mastrena ultra-automatic machines and not fully addressing the low-end threat for what it is. While the Mastrena may be an improvement in visibility of the barista, enabling them to participate in the experience for the customer, it is still an automatic machine. In fact, it automates more of the process, not less.

The supposed expertise of the barista is therefore non-evident -- they can't do any more to improve the espresso shot than can the cashier at McDonalds. The emphasis of the Mastrena is on higher volume (operating efficiency), and any qualitative difference in the cup of coffee between it and the Verisimo machine is so minimal, it is unlikely to be noticed by the majority of caffeine addicts patronizing Starbucks.

Starbucks closes 600 stores. Did too fast growth make them less exclusive as a brand? Did we really need new Starbucks in Starbucks parking lots?

This is a key element, because in no way does the replacement of old machines with the Mastrenas differentiate the end product or in the consumers' mind justify the higher price for Starbucks versus their competition.

Proprietary is not equal to different, and this is a sustaining innovation that reinforces that Starbucks has overshot the needs of their customers, but yet still underperforms on a key dimension -- the expectation of a quality hand-crafted coffee. An expectation that Starbucks created, but has now walked away from.

Secondly, Starbucks gives the appearance of continuing to be in denial that speed and price are performance criteria that a large percentage of their customers deem important, and that many will sacrifice the brand image of Starbucks to get a good enough cup at McDonalds.

Admittedly, this is a very tough line to hold, since through its chain-store ubiquity, Starbucks has ceased to be a unique neighborhood place, becoming instead the middle-of-the-road McDonalds of premium coffee. The only problem is, McDonalds is better suited and better able to be the McDonalds of premium coffee.

How then can Starbucks respond? Can it be different enough to continue commanding a huge price premium over its competition? If not, will business continue to siphoned off by low-end disruptors?

Is there a counter-disruptive response that allows Starbucks to not concede the low-end to McDonalds and Dunkin Donuts while maintaining its higher end niche for hard-core loyalists? Will Starbucks realize that the Mastrena is masking the real problem and that by positioning it as an improvement to the coffee experience, may actually lose more customers as it rolls out (if there is no taste difference, has Starbucks reached the limits of innovation in the core experience).

Will they recognize that purists want a manual shot pulled, or minimally a semi-automatic (because the barista has more control than with a fully automatic)? Can all these needs co-exist?

While we must praise Schultz for the aggressive return to Starbucks origins and a stronger vision, the question now is has he gone far enough, or is the past year a harbinger of much greater disruption to come? Or, has he recognized that disruption is the problem, and there are more surprising announcements to come as a result?

More importantly for investors, is this the end of Starbucks as a growth stock (SBUX - click to see performance over past year compared with Dow Jone and S+P 500), or at about 1/2 the valuation of a year ago, and still dropping, is it a buying opportunity?

Wall Street has been betting against a return to the days of heady growth, but does it have to be that way? I don't think so, but it requires disruptive imagination to see a way out. Perhaps Schultz sees it too.

What do you think?